A GoMaKaBo Insight

Introduction

Mumbai’s real estate market is crowded, noisy, and often overwhelming — with dozens of projects competing for your attention in every micro-market. But not every launch deserves your investment.

Evaluating a real estate project like a pro means going beyond brochures and show flats. It involves understanding location fundamentals, developer credibility, product design, financial metrics, and market positioning — all with a structured lens.

At GoMaKaBo.net, each listed project is already curated using such a framework, helping buyers shortlist faster and smarter.

Location & Connectivity

Location remains the single biggest driver of both capital appreciation and liveability. A great project in a poor location rarely performs well over time.

What to Check:

Distance to business districts & job hubs

Proximity to major transport (highways, metro, rail)

Future infrastructure projects in the vicinity

Liveability of the neighbourhood (schools, hospitals, retail, parks)

| Commute Time to Key Hubs | Avg. Capital Values |

| Under 20 min | Highest premiums |

| 20–40 min | Mid-range pricing |

| 40+ min | Budget segments |

Developer Track Record

A project is only as reliable as the team behind it.

Evaluate:

RERA registration & compliance history

Past delivery record (on time? quality?)

Financial stability & partnerships

Brand reputation in the micro-market

Pro Tip: Stick to developers with multiple completed projects and consistent RERA histories.

Product Planning & Design

Layout and design quality directly affect both everyday liveability and long-term resale value.

Key Parameters:

Layout efficiency (circulation vs usable space)

Natural light & ventilation

Density (units per acre / floor)

Open space ratios

Balconies, setbacks, and privacy between towers

Well-planned projects often command a resale premium of 5–10% over poorly designed ones in the same area.

Amenities & Ecosystem

Amenities are no longer limited to gyms and swimming pools. Buyers today expect a complete ecosystem inside and outside the gates.

Evaluate:

Internal: clubhouse, terraces, co-working spaces, recreational areas

External: schools, hospitals, retail, business hubs within 10–15 mins

Township ecosystem vs standalone amenities

Projects that combine internal lifestyle features with external urban infrastructure tend to offer stronger lifestyle and investment value.

Powerful Closures: Leaving a Lasting Impression

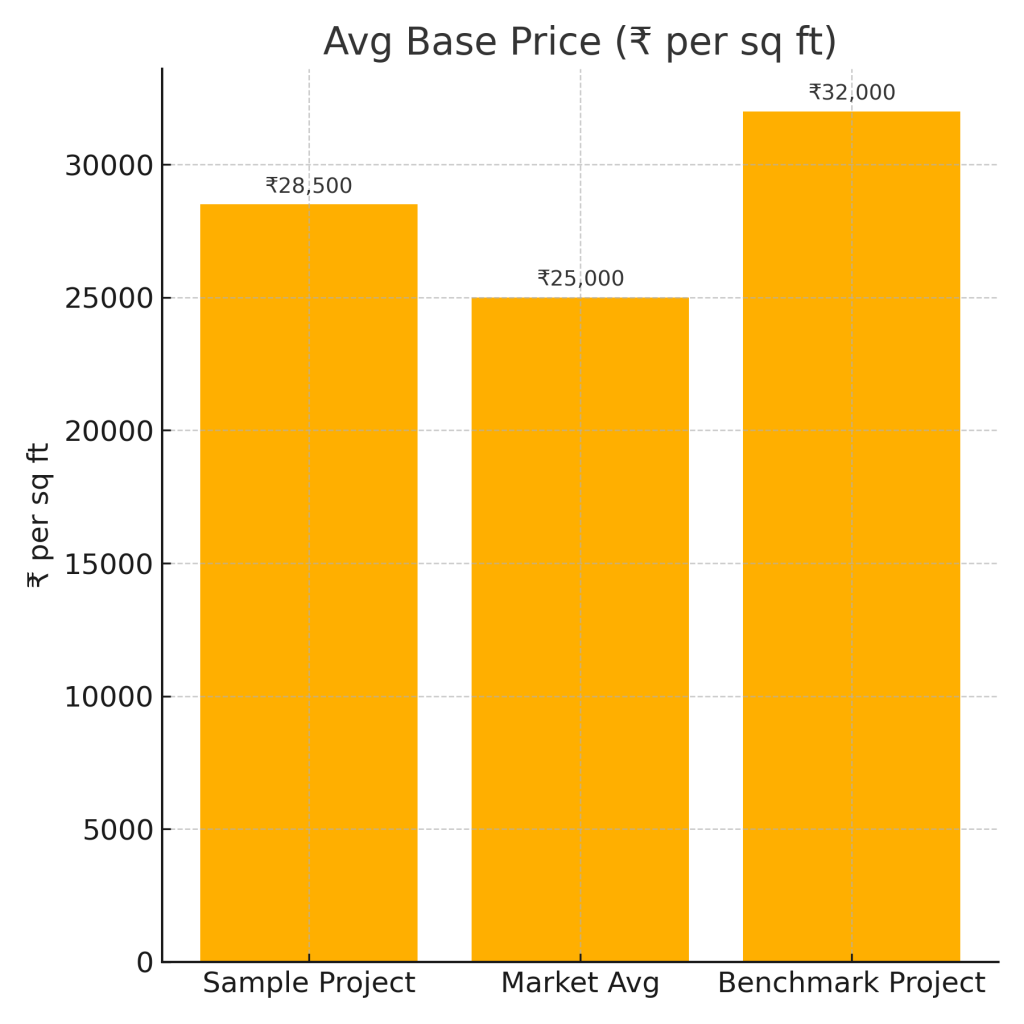

This is where most buyers stop at “price per sq.ft.” — but pros dig deeper

Key Metrics to Assess:

Base price vs micro-market average

Payment plan structure (linked to milestones, subventions, etc.)

Expected rental yield vs other investment options

Potential capital appreciation based on infra drivers

Maintenance costs & outgoings

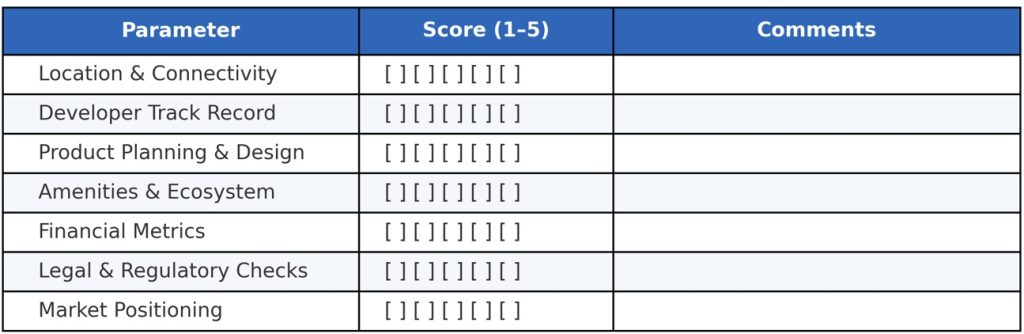

Project Evaluation Checklist — Scoring Framework

Pro buyers assign scores to each parameter and use it to shortlist objectively.

Legal & Regulatory Due Diligence

Always confirm:

RERA registration

Title clarity and encumbrance certificates

Construction & occupation certificates (if ready)

Realistic possession timelines

These checks may seem tedious, but they protect you from years of potential delays or legal headaches.

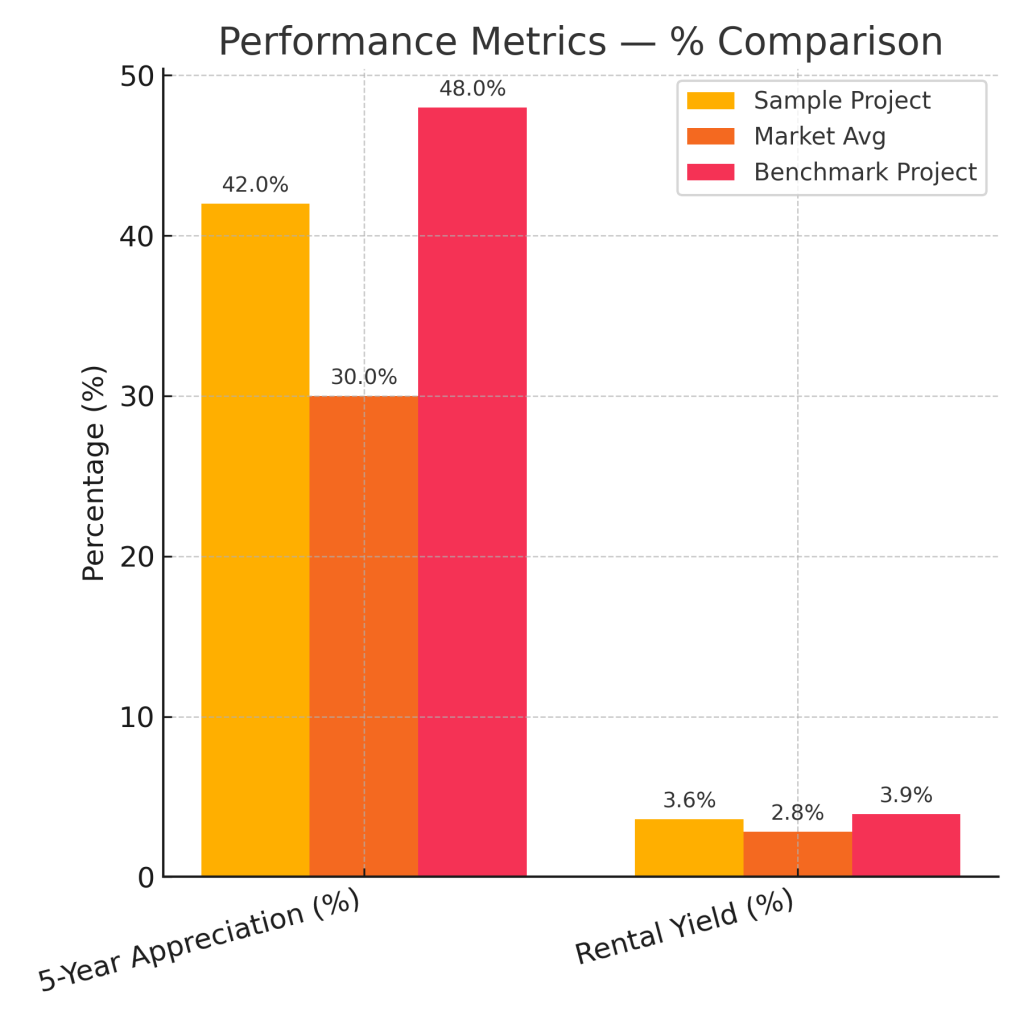

Comparative Market Positioning

A pro doesn’t just evaluate a project in isolation — they benchmark it against its competition.

For example, here’s how a sample branded project compares to its micro-market average and a competing benchmark:

Even small differences in pricing vs positioning can affect both entry strategy and exit value.

Conclusion

Evaluating a real estate project like a pro doesn’t require a degree — just a structured framework.

When applied consistently, it helps you:

- Cut through marketing noise

- Compare apples to apples

- Avoid emotionally driven decisions

- Spot genuine value before everyone else does

At GoMaKaBo.net each listed project is already evaluated against this framework — saving you time, effort, and risk.